What is a Company?

A Company is a separate legal entity that has its own existence and its own tax laws. Provided the annual statutory reporting requirements are met and any taxes owing are paid, it can live forever. Companies have many of the rights and obligations that an individual has, but also have many laws unique to themselves, especially in tax law. A Company can own assets, borrow money etc.

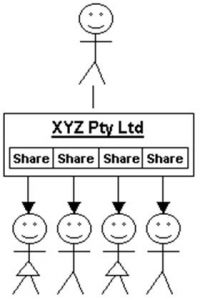

How a Company Works

Directors: control and are responsible for the Company. NOT necessarily owners.

Company: is a legal entity i.e. it exists independently of directors and owners, and “holds” the assets.

Shares: the Company is divided into portions called a share. Shares are ownerships rights i.e. if you own shares you own a part of the Company.

Shareholders: own the shares. i.e. own the Company.

NOTE: the shareholders cannot be used for the wrong doings of the Company – the Company itself can, and the directors can, but not the shareholders.

Advantages to using a Company

- Limitation of Liability – Subject to action which may be taken by creditors or the ATO if directors carry on business while the Company is unable to pay its debts, or act negligently, the liability of shareholders is limited to the amount they have subscribed for their shares.

- Permanency – A Company can have an indefinite life. Shareholders may come and go, but the Company continues unless there is a decision by shareholders (or creditors if the Company can’t pay its debts) to liquidate the Company. Business operation is therefore not dependent on the continued presence of an individual.

- Multiple Ownership – Multiple Ownership of the Company can be easily accommodated by the issue of any number of shares. Rights of individual shareholders can also be varied by the issue of different class shares.

- Lower Tax Rates – Whilst an individual’s highest tax rate (including Medicare levy) is 47%, small Companies are taxed at a flat rate of 25% if your turnover is less than $10 million. If your turnover is greater than $10 million then it is taxed at 30%.

Disadvantages of using a Company

- Complexity – Companies are regulated by the Corporations Act, which is administrated by the Australian Securities and Investments Commission (ASIC). Directors must comply with duties and obligations as outlined in the Act which, among many other things, requires financial accounts to be prepared annually and annual returns lodged with ASIC. Returns and notifications have to be lodged with ASIC and substantial penalties accrue if lodged late.

- Capital Gains Tax – The 50% discount on CGT for individuals is not available to Companies. Whilst the tax rate may be lower Companies will be subject to tax on full gain of assets sold, with indexation frozen as at 30 September 1999.

- Distributions – Any distributions of income or capital to the shareholders during the lifetime of the Company will be taxed as dividends.

- Liquidation – Any distribution to shareholders on the liquidation of the Company (except gains from sale of pre-CGT assets) will be treated as taxable dividends.

- Loans to Shareholders – Any loans or payments made by a private Company to its shareholders or associates which remain unpaid at the end of the financial year will be treated as unfranked dividends for taxation purposes unless a loan facility agreement is in place.

Book an appointment now to discuss your business needs by calling the team at ATOM Accounting & Taxation on 5452 7205.