What is a Trust?

A Trust is a separate legal entity that also has its own common and tax laws. Because a Trust is an entity on its own the people who benefit from any distributions made by the Trust (the beneficiaries) cannot be held liable for the actions of the Trust. The Trust owns the assets and because there are no shareholders (unlike a Company) there is no “owner” of the Trust.

The major advantage a Trust has over a Company or individual is income splitting (income splitting means simply that you can divert income to people in lower tax brackets).

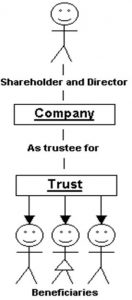

The recommended way to set up a Trust structure is to have a $2 Company as Trustee and you be the director of the $2 Company.

How a Trust Works

You are the director and shareholder of the Company (that owns NOTHING), which means that you control the Company.

The Company is the Trustee for the Trust (that owns EVERYTHING), therefore, as director of the Trustee, you control the Trust.

The Trust distributes all profits to the beneficiaries, (who you nominate). i.e. yourself, spouse, children, parents, friends, etc.

Benefits of using a Trust

- You can claim any expense that is incurred in running the business (or investment).

- You spend before you pay tax.

- Liability is limited.

- You divert income to any beneficiary you want (i.e. those on the lower tax rates) and you can change the proportions of income each receives each year. Subject to the Personal Services Income rules.

- Because a Trust cannot die there are no capital gains tax or stamp duty costs when you die – assets can be passed on generation after generation with no tax implications.

- Assets are protected. Nobody can take your assets because the Trust owns the assets, not you.

- Upon the sale of an asset the beneficiary of the Trust pays the reduced rate of capital gain tax.

This is a very difficult area and specialised tax advice is recommended.

Book an appointment now to discuss your business needs by calling the team at ATOM Accounting & Taxation on 5452 7205.